nc sales tax on prepared food

The Wake County Board of Commissioners levied a Prepared Food and Beverage Tax of 1 of the sale price of prepared food and beverages effective January 1 1993. Exact tax amount may vary for different items.

Sales Tax On Groceries Sales Tax Data Link

A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food.

. ECheck Option Now Available. Prepared Food Beverage. The exemption only applies to sales tax on food purchases.

To learn more see a full list of taxable and tax-exempt items in North Carolina. Aviation Gasoline and Jet Fuel. One percent 1 of the sales derived from prepared food and beverages sold is assessed at retail for consumption on or off the premises are assessed by any retailer within the County that is subject to sales tax imposed by the State of North Carolina.

How can we make this page better for you. The tax is in addition to state and local sales tax. A 1 tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises and applies to any retailer with sales in Cumberland County subject to sales tax imposed by the State of North Carolina under NCGS.

The Pitt County Sales Tax is collected by the merchant on all qualifying sales made within Pitt County. You can find more examples of when prepared food is and is not taxable in Section 32 of the latest North Carolina Sales and Use Tax Bulletin. Are meals taxable in North Carolina.

The Mecklenburg County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Mecklenburg County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. North Carolina Department of Revenue. This tax is in addition to State and local sales tax.

Prepared Food Beverage. Download all North Carolina sales tax rates by zip code. A 1 tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises and applies to any retailer with sales in Cumberland County subject to sales tax imposed by the State of North Carolina under NCGS.

General Sales and Use Tax. Taxation of Food and Prepared Food. For example Wake County imposes a 1 tax prepared food and beverages.

Ad Get North Carolina Tax Rate By Zip. This page describes the taxability of food and meals in North Carolina including catering and grocery food. This tax is administered by the county and is not subject to the exemption.

Non-Qualifying Food Dietary Supplements Food Sold Through a Vending machine Prepared Food Certain Bakery Items Soft Drinks Candy. Prepared Food is subject to a higher state sales tax then other items. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

Aircraft and Qualified Jet Engines. Free Unlimited Searches Try Now. Download all North Carolina sales tax rates by zip code.

The North Carolina NC state sales tax rate is currently 475. Download all North Carolina sales tax rates by zip code. This tax is in addition to the combined state and local sales tax collected and remitted to.

Thereto levy a prepared food and beverage tax of up to 1 of the sales price of prepared food and beverages sold within the town at retail for consumption on or off the premises by a retailer subject to sales tax under General Statute 105-1644a1. The Pitt County North Carolina sales tax is 700 consisting of 475 North Carolina state sales tax and 225 Pitt County local sales taxesThe local sales tax consists of a 225 county sales tax. Food Non-Qualifying Food and Prepaid Meal Plans.

Subsequently What is the sales tax on prepared food in NC. The Watauga County North Carolina sales tax is 675 consisting of 475 North Carolina state sales tax and 200 Watauga County local sales taxesThe local sales tax consists of a 200 county sales tax. Sales Use Tax.

475 Average Sales Tax With Local. PO Box 25000 Raleigh NC 27640-0640. NC State is not exempt from the prepared food and beverage taxes administered by local counties and municipalities.

Items subject to the general rate are also subject to the 225 local rate of tax that is levied by all counties in North Carolina. The transit and other local rates do not apply to qualifying food. The Food and Beverage tax rate for Dare County is 1 of the sales price of prepared foods and beverages sold within the county for consumption on or off a premises by a retailer who is subject to sales tax under GS.

Goods sold by artisan bakeries without eating utensils are considered non-taxable at the state level though they are subject to the 2 local sales tax just like groceries. This tax is in addition to the combined state and local sales tax collected and remitted to. Prescription Drugs are exempt from the North Carolina sales tax.

Mecklenburg County hereby levies a prepared food and beverage tax of one percent 1 of the sales price of meals and prepared food and beverages sold at retail for consumption on or off the premises by any retailer within Mecklenburg County that is subject to sales tax imposed by the State of North Carolina under Section 1051644 a 1 of the North Carolina - General. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 75. Skip to main content Menu.

Lease or Rental of Tangible Personal Property. A 1 tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises and applies to any retailer with sales in Cumberland County subject to sales tax imposed by the State of North Carolina under NCGS. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

What Are State Sales Taxes Turbotax Tax Tips Videos

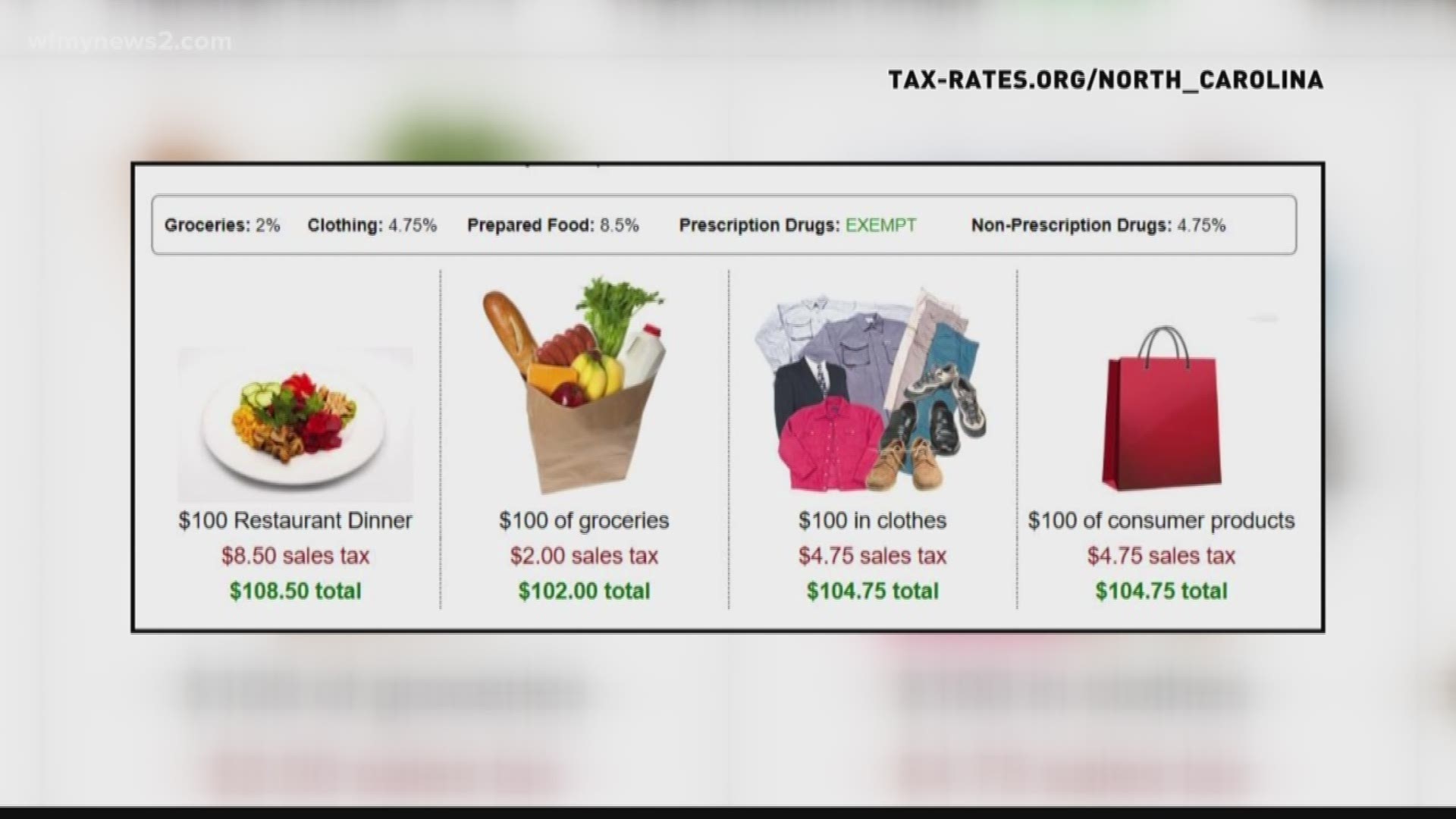

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Understanding California S Sales Tax

Are You Required To Pay Sales Tax On Restaurant Food Purchased For Resale

Taxes On Food And Groceries Community Tax

Change To Bill Cutting Missouri Sales Tax On Food Transformed It Into Massive Tax Hike Missouri Independent

Is Food Taxable In North Carolina Taxjar

Flush States May Exempt Food From Sales Tax

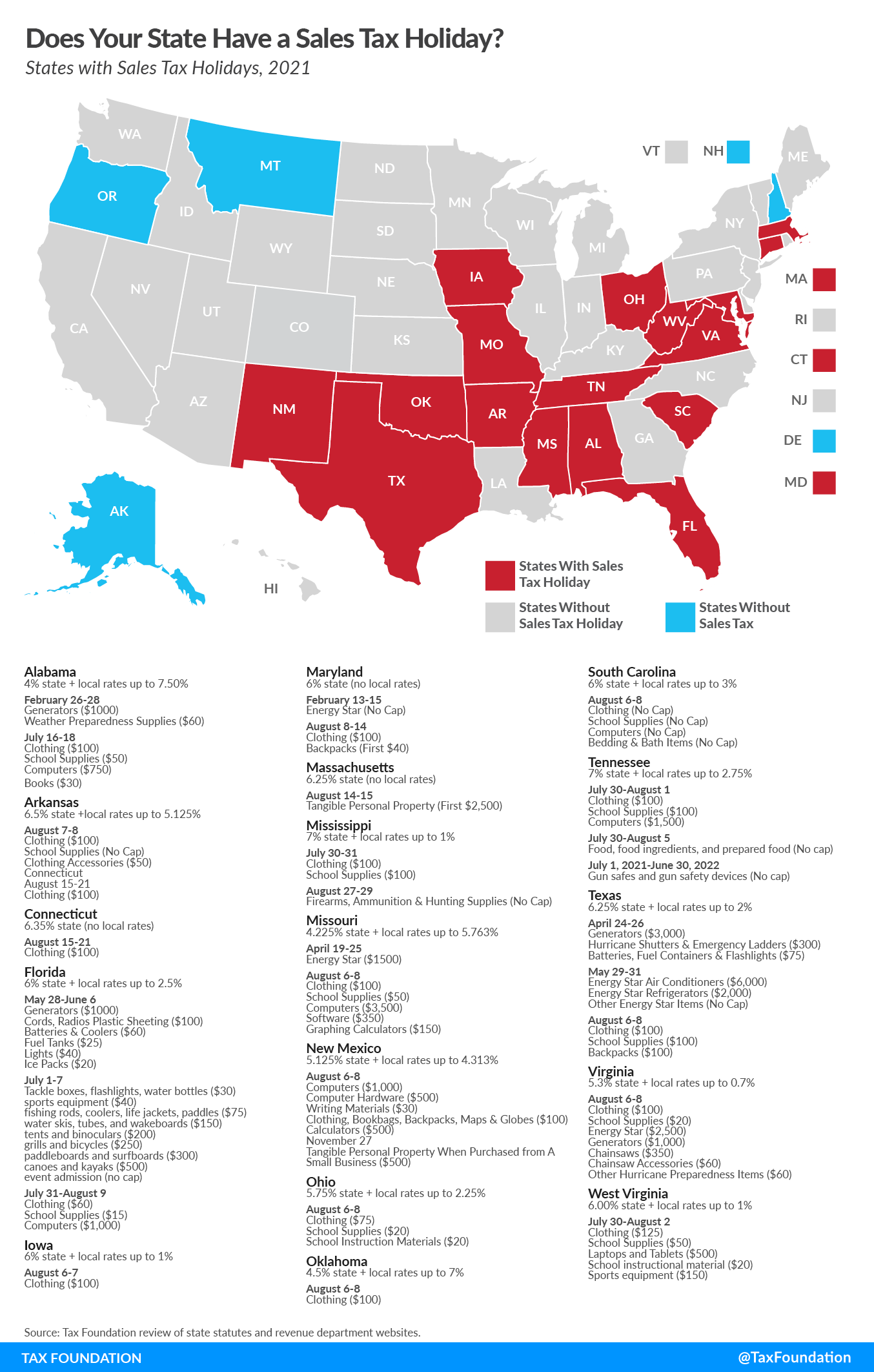

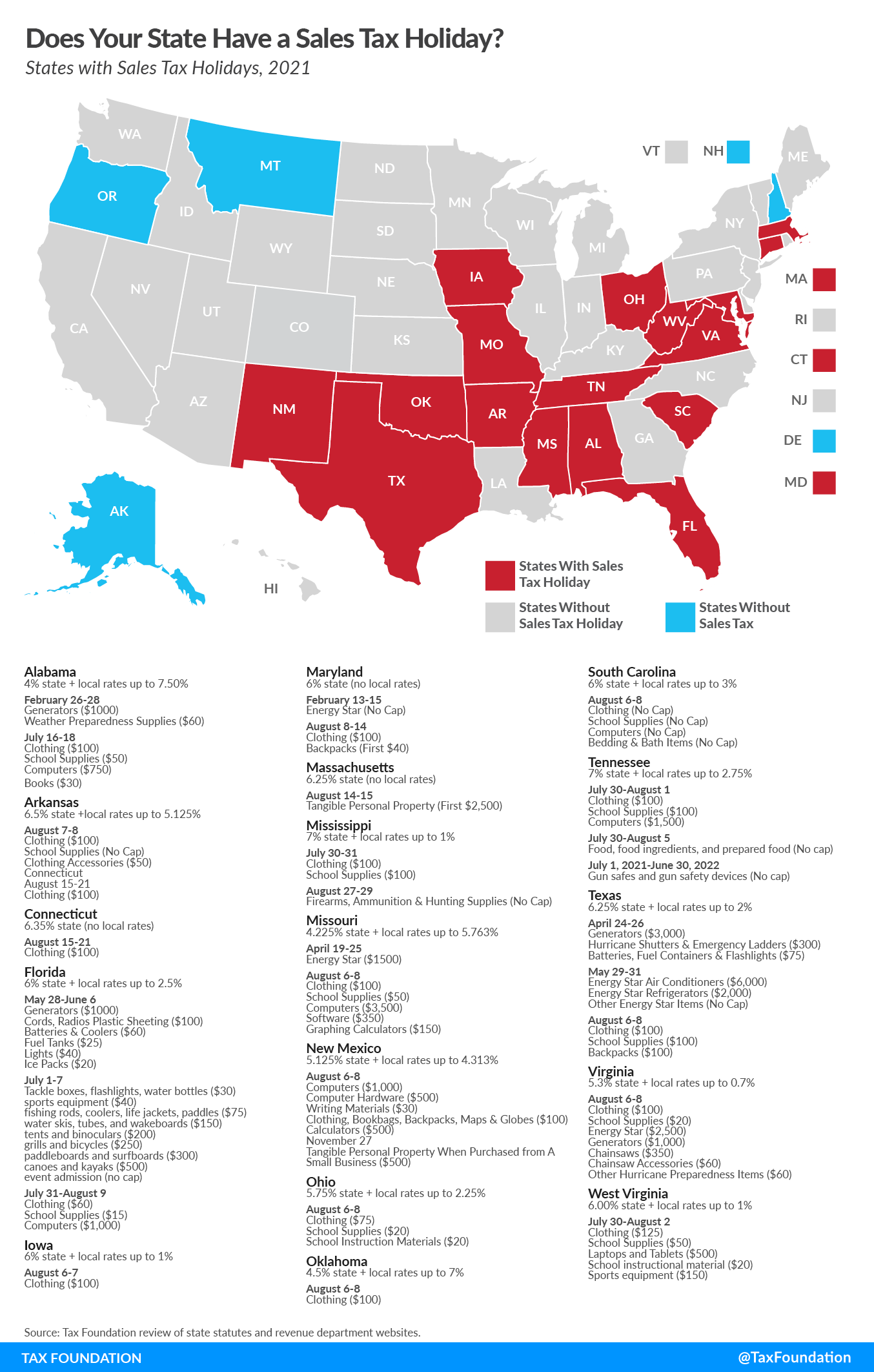

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Is Food Taxable In North Carolina Taxjar

Flush States May Exempt Food From Sales Tax

Is Food Taxable In North Carolina Taxjar

Tax Free Week Starts Today For Hurricane Supplies Be Prepared Now Instead Of Waiting Until A Storm Is Heade Plastic Drop Cloth Tax Holiday Reusable Ice Packs

Deductions For Sales Tax Turbotax Tax Tips Videos

Sales Tax On Grocery Items Taxjar

Sales Tax Holidays Politically Expedient But Poor Tax Policy