nj application for tax clearance certificate instructions

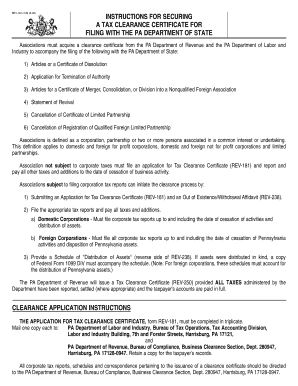

2 Filing the appropriate tax reportsreturns and paying all taxes interest and penalties. Tax Clearance Certificates are valid for 180 days.

Form A 5088 Tc Application For Tax Clearance And Instructions

Questions about the award process should be directed to the issuing State Agency noted on page 1.

. Entity in New Jersey. It certifies that a business or individual has met their tax obligations as of a certain date. Agency Contact Phone - 732-218-3400.

After July 1 2017 any applicant for certification that cant obtain a Premier Business Services. If expired follow the instructions via the online portal to re-issue. After you are registered on the My New Jersey Portal use the following steps to print or get a PDF of your tax clearance certificate.

Correspondence and eventual issuance of Tax Clearance Certificate should be addressed to. Business Tax Clearance Certification Required for Receiving State Grants Incentives. Agency Contact Phone - 732-855-0033.

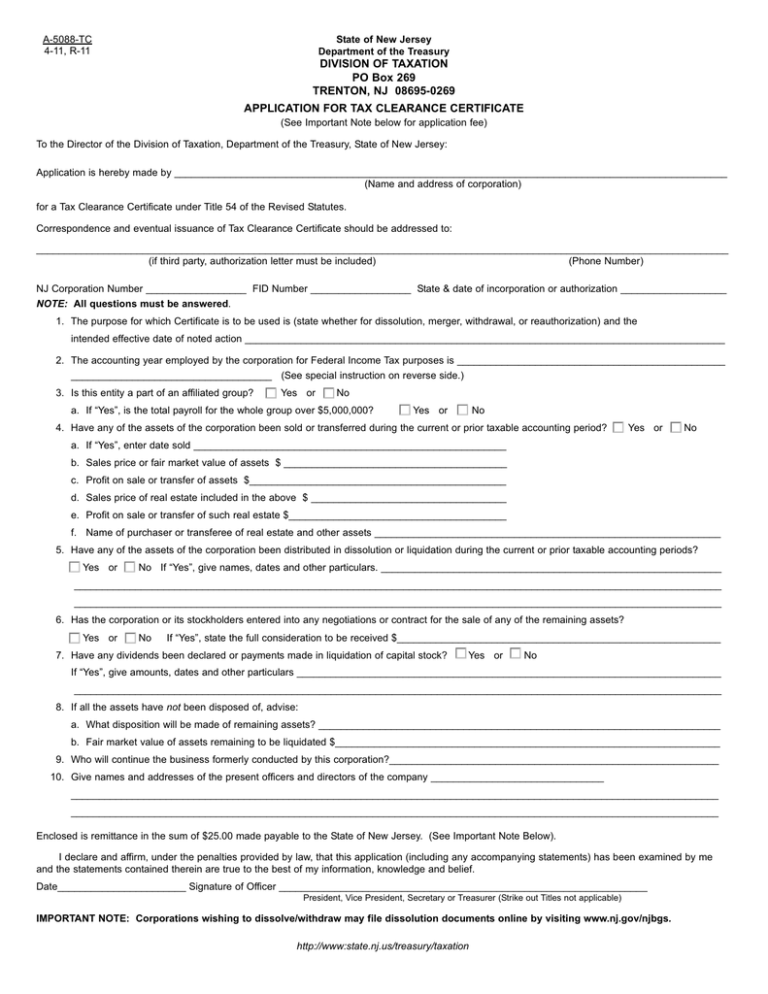

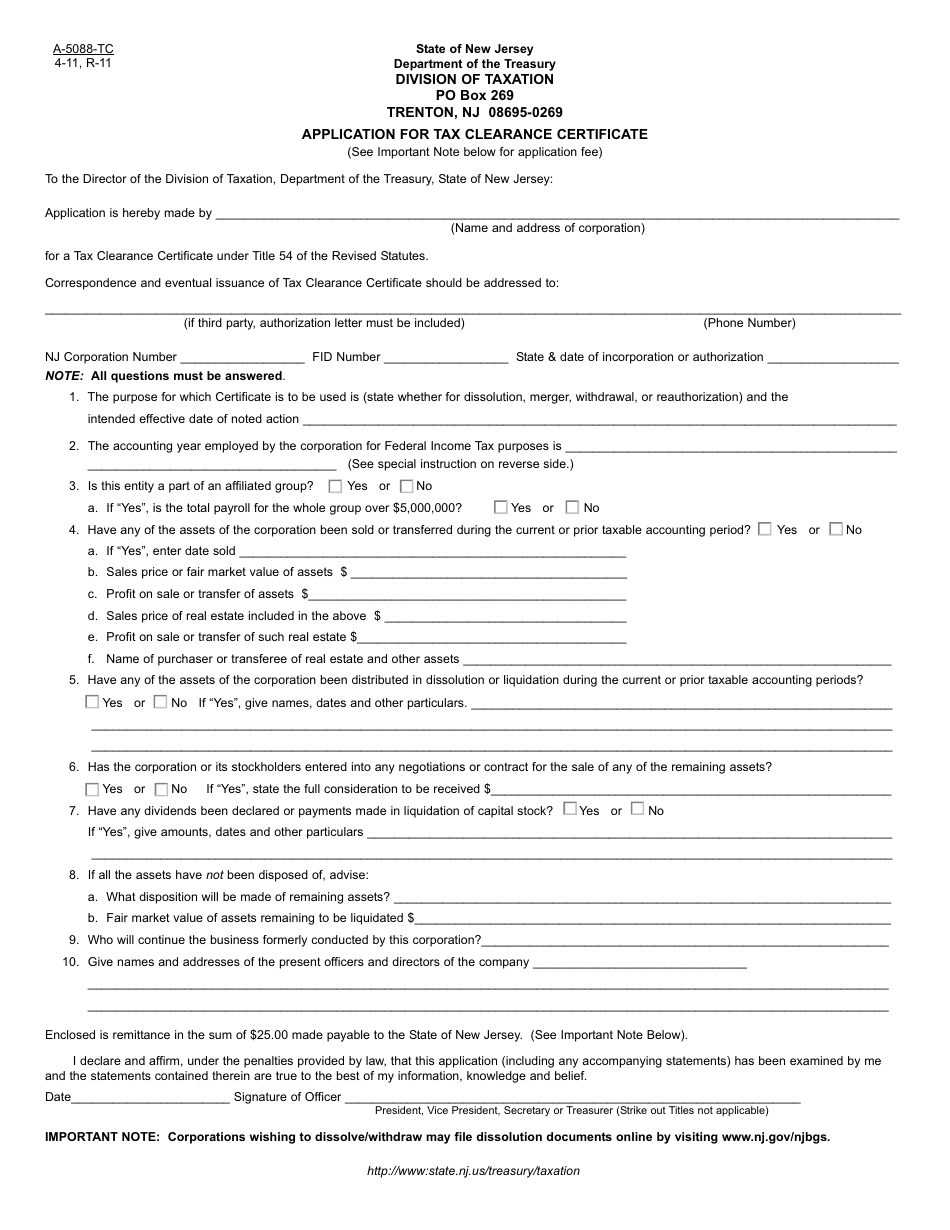

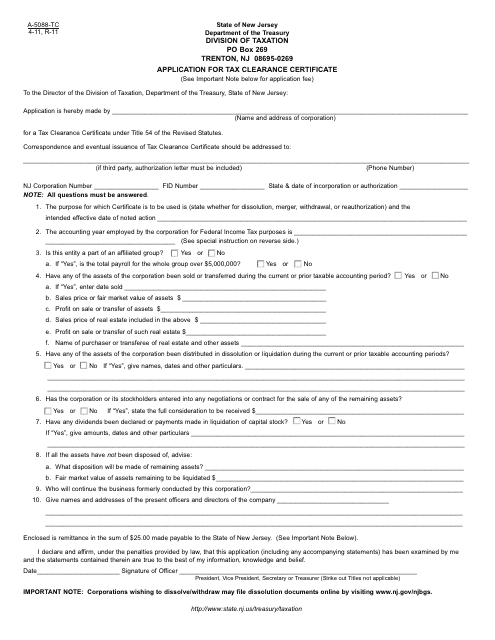

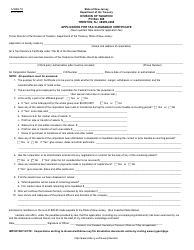

And Payment of 120 95 dissolution fee and 25 tax clearance certificate application fee. Questions about the tax clearance process may be directed to. A-5088-TC 4-11 R-11 State of New Jersey Department of the Treasury DIVISION OF TAXATION PO Box 269 TRENTON NJ 08695-0269 APPLICATION FOR TAX CLEARANCE CERTIFICATE See Important Note below for application fee To the Director of the Division of Taxation Department of the Treasury State.

New Jersey Division of Taxation Tax Clearance Unit PO Box 277 Trenton New Jersey 08695. Instructions for filing tax returns can be found on the form Procedure for Dissolution Withdrawal or Surrender. Application Number - As assigned by the Program.

If expired follow the instructions via the online portal to re-issue. Nj Gov Njbgs a 5088 Tc 2011-2022 Form. A Tax Clearance is an official document issued by the Bureau of Internal Revenue BIR in the Philippines.

And Application for Tax Clearance Certificate Form A-5088-TC. After July 1 2017 any applicant for certification that cannot obtain a Premier Business Services account may submit a paper application Gtb-10 for business assistance tax clearance. Please note that the issuance of the Tax Clearance Certificate is a lengthy process and may take several months.

Ad Download Or Email Form GTB-10 More Fillable Forms Register and Subscribe Now. Under the tax revenue center select tax services then select business incentive tax clearance. All others must submit their applications through the Premier Business Services Portal.

Agency Contact Address - CLEAResult 75 Lincoln Highway Suite 100 Iselin NJ 08830. CLEAResult does not accept Tax Clearance Applications. 1 Go to - httpsmystatenjusauiLogin 2 Enter your Login ID and password.

Application is hereby made by _____ Name and address of corporation. Ad Download Or Email A-5052-TC More Fillable Forms Register and Subscribe Now. Application Number - As assigned by the Program.

APPLICATION FOR TAX CLEARANCE CERTIFICATE Prepare and remit with 2500 fee A-5088-TC 8-99 R-8 To the Director of the Division of Taxation Department of the Treasury State of New Jersey. Ad Download Or Email Form GTB-10 More Fillable Forms Register and Subscribe Now. Select a Premium Plan Get Unlimited Access to US Legal Forms.

Tax Clearance Certificates are valid for 180 days. Application for Tax Clearance and Instructions. Get started with a taxation clearance certificate 2011 complete it in a few clicks and submit it securely.

And Estimated Summary Tax Return Form A-5052-TC with schedules completed on an estimated basis for the current. Entities required to file corporation tax reportsmay initiate the tax clearance process by. Instructions for filing tax returns can be found on the form Procedure for Dissolution Withdrawal or Surrender.

New Jersey offers grants incentives and rebates to businesses and every recipient must obtain a business assistance tax clearance certificate from the Division of Taxation. Tax clearance is required for all for-profit corporations to end their business in the State of New Jersey. TRC does not accept Tax Clearance Applications.

Fill Edit Sign Forms. New jerseys online annual reports and change services. 1 Submitting an Application for Tax Clearance Certificate REV-181.

If expired follow the instructions via the online portal to re-issue. . There is a 2500 fee that is to be submitted with each Application for the Tax Clearance Certificate Form A-5088-TC.

It is commonly requested by the taxpayers or businesses used as a verification to the investors or clients that the business is tax compliant or of good standing. Tax returns and has not paid all tax penalties interest or fees due the Director shall issue a notice to the applicant of the particulars to be resolved before a tax clearance certificate may be issued. Also list the date of execution signature.

Be sure to include the State and date of incorporation or date of authorization. Application for Tax Clearance Certificate must be typed or printed. Application for Tax Clearance Certificate must be typewritten or printed and should be addressed to.

TRC does not accept Tax Clearance Applications. Make sure the corporate name is spelled correctly. All Tax Clearance Applications must be completed via the Division of Taxation online Premier Business Services Portal.

Even a slight misspelling will generally make it difficult to identify the corporation for which the application is made. Certificate under Title 54 of the Revised Statutes. Application for Tax Clearance Certificate must be typewritten or printed and should be addressed to.

The corporate structure determines the proper form. Agency Contact Address - 900 Route 9 North Suite 404 Woodbridge NJ 07095. Email businessassistancetctaxationtreasnjgov for assistance.

Application Number - As assigned by the Program. New Jersey Division of Taxation Tax Clearance Unit PO Box 269 Trenton New Jersey 08695-0269. EXECUTION SignatureDate Have the chairman president or vice-president of the each business entity sign.

Tax Clearance Certificates are valid for 180 days. The application for Tax clearance will be submitted to the Division of Taxation electronically.

Division Of Taxation Po Box 269 Trenton Nj 08695 0269

3 12 217 Error Resolution Instructions For Form 1120 S Internal Revenue Service

Form A 5088 Tc Download Fillable Pdf Or Fill Online Application For Tax Clearance Certificate New Jersey Templateroller

Irs Form 8802 Application For United States Residency Certification

Rev 181 Instructions Fill Online Printable Fillable Blank Pdffiller

Form A 5088 Tc Application For Tax Clearance And Instructions

Form A 5088 Tc Download Fillable Pdf Or Fill Online Application For Tax Clearance Certificate New Jersey Templateroller

South Shore Plenny Twin Daybed Reviews Wayfair

Form A 5088 Tc Download Fillable Pdf Or Fill Online Application For Tax Clearance Certificate New Jersey Templateroller